alameda county property tax phone number

Please visit our office or call 510 272-3787 for more information. Lookup or pay delinquent prior year taxes for or earlier.

City Of Oakland Check Your Property Tax Special Assessment

1221 Oak Street Room 131.

. Public records are located in the County Administration Building 1221 Oak Street Room 145 Oakland. Winton Avenue Room 169. Please call 510 272-3787 for further information.

All numbers are in the 510 area code Telephone Number. A convenience fee of 25 will be charged for a credit card transaction. Office closed on Alameda County holidays Links Department Website.

The Treasurer-Tax Collector TTC does not conduct in-person visits to collect. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County. This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM.

Owners who would like to have their. Name Alameda County Tax Collector Address 221 Oak Street Oakland California 94607 Phone 510-272-6800 Hours Mon-Fri 830 AM-500 PM. We accept Visa MasterCard Discover and American Express.

1221 Oak Street Room 131 Oakland CA 94612 5102726800 Monday - Friday. Property Tax Information Telephone Number. 074 of home value.

Californias median income is 78973 per year so the median yearly property tax paid by California residents amounts to approximately of their yearly income. As we continue our effort to ensure the health and safety of the public and our staff our offices in Oakland and Hayward will remain closed until further notice. You can pay online by credit card or by electronic check from your checking or savings account.

The phone number. 510 272-3836 Toll Free. Counties in California collect an average of 074 of a property s assesed fair market value as property tax per year.

Pay Your Property Taxes Online. Alameda county property tax phone number has one of the highest average property tax rates in the country with only nine states levying higher property taxes. Ownership information for a limited number of parcels may be obtained by calling 510 272-3787.

Address Phone Number and Hours for Alameda County Tax Collector a Treasurer Tax Collector Office at Oak Street Oakland CA. Information on due dates is also available 247 by calling 510-272-6800. Assessors Office Public Inquiry 1221 Oak Street Room 145 Oakland CA 94612.

Directions to our office. The median property tax in California is 283900 per year for a home worth the median value of 38420000. No fee for an electronic check from your checking or savings account.

510 272-6807 - FAX. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in. California is ranked.

1221 Oak Street Room 131 Oakland CA 94612. Property ownership is also available in writing for a fee. Alameda County Assessors Office.

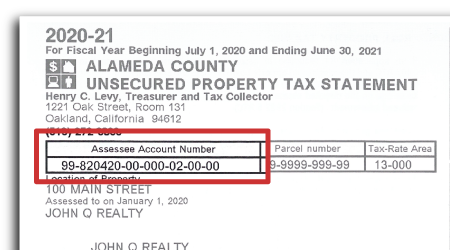

The Assessors Office maintains building characteristics information for assessment purposes. Parcel number and property address information can be found on the Treasurer-Tax. It is important to note that Government Code Section 29853 and Alameda County Administrative Code Section 404080 require a waiting period of 20 days from the date the original warrant was issued before a replacement warrant may be issued.

The system may be temporarily unavailable due to system maintenance and nightly processing. For all inquiries please include your parcel number location of property address tax year and for unsecured accounts include. For County assistance please call 5102089770 for a menu of County Agencies and Departments.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Alameda County Treasurer-Tax Collector. The business hours are from 830 am to 500 pm weekdays.

Tax amount varies by county. You can also lookup telephone numbers in the County Telephone Directory. If your property.

Go to Property Assessment Information and search by Assessors parcel number or by property address to download the map. 1221 Oak Street Room 249. Alameda County Tax Collector Contact Information.

Building characteristics are not part of the assessment roll and are made available to the property owner with identification free of charge. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. Dear Alameda County Residents.

Business Personal Property Office Located at. The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices. 510 272-3836 Toll Free.

Dear Alameda County Residents. The due date for property tax payments is found on the coupon s attached to the bottom of the bill. 125 12th Street Suite 320 Oakland CA 94607.

If your property has been affected by the recent Canyon Fire.

Commercial Rents Tax Cr Treasurer Tax Collector

How To Pay Property Tax Using The Alameda County E Check System Alcotube

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Contact Us Alameda County Assessor

Free Open House Flyers For Realtors 2021 Remarkable Ideas

Alameda County Property Tax News Announcements 11 08 21

Monopoly Man Monopoly Man Music Business Alameda County

California Public Records Online Directory